Recent Blog Posts

-

What It Means to Be a Treasurer

A Treasurer is responsible for managing the financial health of an organization. Their main duties include creating and overseeing budgets, keeping accurate records of income and expenses, handling payments and reimbursements, and ensuring that funds are used responsibly. They often… Continue reading

-

What is a Credit Score and why does it matter?

What is a Credit Score? A credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay borrowed money. Lenders, such as banks and credit card companies, use this score to decide whether to… Continue reading

-

The Basics of Investing

Investing is a powerful way to grow your wealth over time by putting your money to work. Unlike saving, where your funds typically sit in an account earning minimal interest, investing involves buying financial assets that have the potential to… Continue reading

-

Types of Savings Accounts: Regular, High-Yield, and Certificates of Deposit

Savings accounts are essential tools for growing and developing your money overtime. Even teenagers like me can benefit and get experience from using one. These accounts enable you to safely store funds with a sum of interest being built up… Continue reading

-

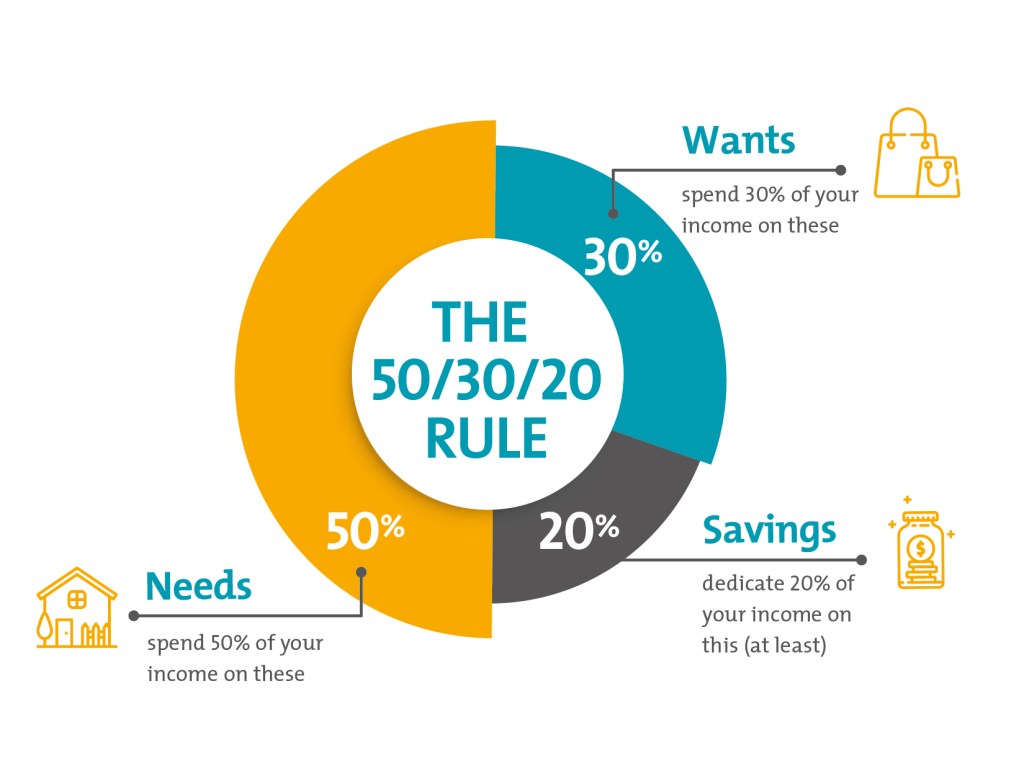

The 50/30/20 Rule: A Beginner’s Guide to Budgeting

In this post, I’ll be going over the popular 50/30/20 Rule where anyone can start creating a balance of spendings and start saving for the future. Continue reading

-

The Psychology of Money: A Personal Perspective

This book goes into depth about how financial knowledge is not the only thing necessary dealing with Financial Literacy, but also the mental aspect to it. In this article, I’ll be giving my honest opinion on the book. Continue reading