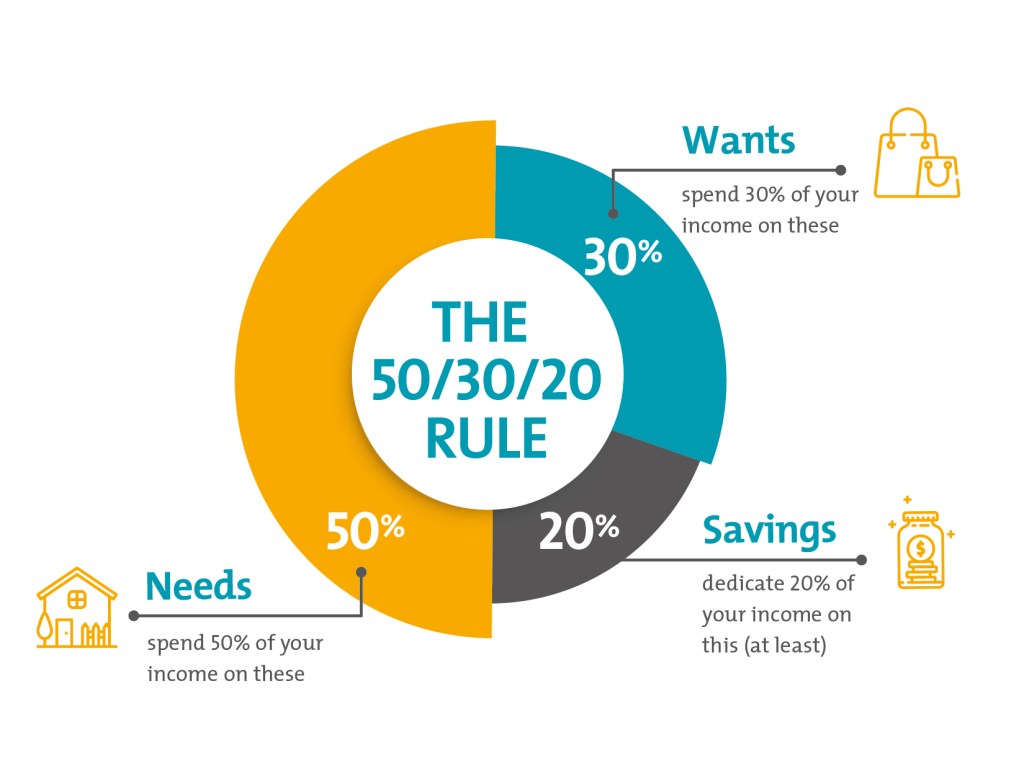

The 50/30/20 rule is a simple but effective method that enables individuals to manage their finances easily. Developed by the U.S Senator Elizabeth Warren with her daughter within their book All Your Worth: The Ultimate Lifetime Money Plan, this method divides your budget into three main sections: needs, wants, and debt repayment. It is a beginner-friendly rule for people like me that paves the way for financial stability, making it very useful for people just starting to manage money.

The first part stands for 50% of your income, or represents your needs, which comprises your expenses required to maintain your standard of life. This might include rent, tools, food, transportation, etc. Needs are expenses in your life which you take the highest priority for. The 50% limit ensures that you don’t overextend your expenses while also creating room for other financial purchases you might need.

The second 30% of your income goes into wants, or things that you desire but shouldn’t prioritize because they aren’t as essential. Many non-essential expenses are things like entertainment, vacations, and hobbies. Wants give enjoyment and elevate your standard of life , but aren’t essential to your day to day activities. By capping your wants to 30%, it helps you regulate yourself in your spending and keep your on track to become financially responsible, making sure these purchases don’t derail you from your financial goals.

The last 20% is reserved for your savings and debt repayment. This might include emergency funds, retirement accounts, and long-term savings for significant goals such as buying a home or starting up a business. If you have high-interest debt, this portion of your income can also go to paying it down dramatically. Allocating 20% of your income into this section can make sure that you not only are prepared for the future but also reducing any financial stress you might have due to and complications that you encounter.

The 50/30/20 Rule is a simple but very effective method that anyone can use in order to become more organized maintain and economic balance within your life. This rule demonstrates awareness of where all your spendings go as well as helps you align your income with your goals for the near or far future. By following this rule, you can create a financial basis where you can have a financial balance between building up a future as well as enjoying the present to your utmost capability.

Leave a comment